To safeguard your assets from potential claims in New Zealand, it is essential to implement effective legal strategies. By taking proactive measures, you may be able to minimise the risk of substantial losses and ensure the preservation of your valuable assets. Here are key asset protection measures to consider:

1. Limited Liability Entities: Forming companies or limited liability entities is a crucial asset protection strategy. This creates a clear separation between personal and business assets, limiting liability to the entity and protecting personal assets from claims against the business. Proper corporate governance and compliance are vital for this strategy’s effectiveness.

2. Discretionary Trusts: A discretionary trust offers asset protection and a long-term succession plan for your family. By transferring assets into the trust, you may be able to protect them from creditor claims and Family Protection Act claims in certain circumstances while providing for your family members. Beneficiaries can benefit according to the trust’s terms, facilitating the orderly distribution of wealth.

3. Insurance: Obtaining comprehensive coverage, such as professional indemnity or liability insurance, is fundamental. Insurance serves as a safety net in case of third-party claims, covering legal costs, settlements, and damages. Regularly review and update your insurance policies to align with your asset protection goals.

4. Pre-emptive Planning: Engage in proactive measures by seeking advice from experienced legal professionals. Customised strategies can be developed to identify risks, implement protective measures, and minimise exposure to claims. Regularly review and update your asset protection and succession plan to adapt to changes.

Asset protection strategies including limited liability entities, discretionary trusts, insurance, and pre-emptive planning can effectively protect your assets in New Zealand. You should consult with experienced legal professionals specialising in asset protection to develop a customised plan that safeguards your financial well-being.

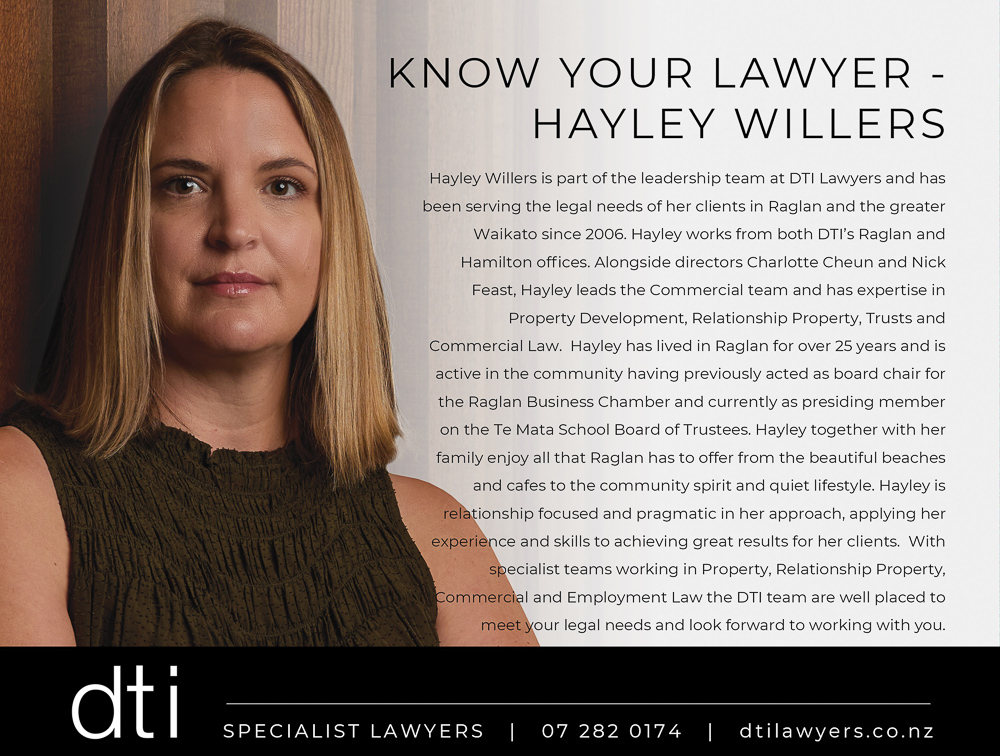

Our specialised team at DTI Lawyers is available to assist, contact Director, Hayley Willers for an appointment in Raglan to discuss your asset planning and protection needs.

With Hayley Willers – DTI Lawyers