Blended families are becoming increasingly common and careful planning is required to reduce the risk of challenges to your estate on your death.

Whilst you may be happy to provide for your partner in the event of your death you may wish for your assets to then pass to your partner’s children if you have children of your own.

The Problem

There are a number of ways in which your property or your family trust’s property can be lost.

One tool people use is to keep income and assets separate, but this can be disregarded under the law when a triggering event occurs such as a separation, death, or one partner moving into residential care.

Your Will can make your intentions clear, but on your death, your surviving partner may choose to claim their entitlement under relationship property law. Your children may also choose to challenge your Will.

While Trusts are a very useful asset planning vehicle, in many situations Trust assets can become available for division by the Court in the event of a separation.

Risk also arises from the way couples own their property. If you own property jointly with your partner rather than in shares, on your death your interest in the property passes directly to your partner by survivorship.

The Solution

Carefully considered and formally recorded relationship property agreements can provide mutually agreed outcomes in the event of separation or when you die.

Life interest Wills can protect a partner from being forced to leave the relationship home during their lifetime while, at the same time, protecting your interest for your children.

If done right, Trusts can also be a very useful tool for preserving assets. Careful drafting of the Trust Deed is essential. It is important to note however that arrangements made a short period before a relationship or marriage starts are still at risk. The gold standard is to ensure you have a relationship property agreement.

Where you own property as a joint tenant, you can sever the joint tenancy, and separate your interest in the property.

Mutual Wills can be an option for some couples. A mutual Will includes a binding mutual promise that records your intention not to revoke or change your Wills during your lifetimes and after the other’s death.

Doing nothing is unwise. The cost and upset caused by a family dispute arising on separation or death can often be avoided or minimised by taking proper legal advice at the right time – sooner rather than later.

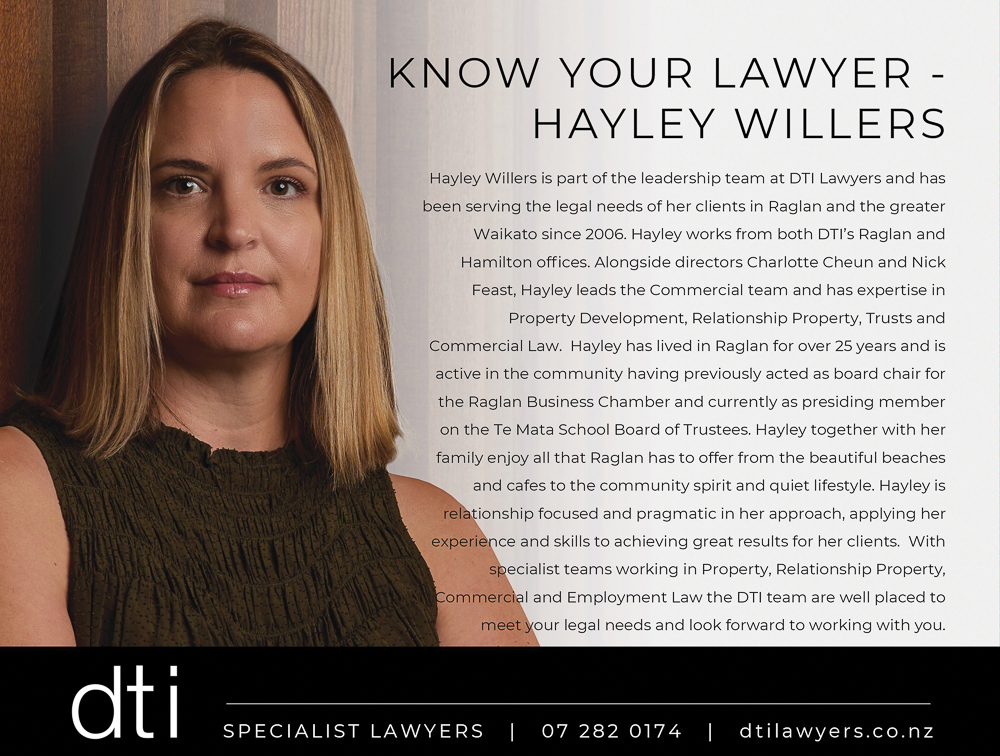

At DTI Lawyers, we have a team of lawyers with experience in this area who are happy to help. For assistance with your asset planning, contact Hayley Willers who is available to see clients in Raglan on Wednesday afternoons.